Meaningful Financial Education in the Primary Classroom

Discover simple, engaging ways to help children build confidence and understanding around money.

In this article, Paul Street, former headteacher and financial education expert, shares practical insights on delivering meaningful financial education in the primary classroom.

why financial education matters in primary school

We all know how important developing life skills is for children. Learning about money is certainly becoming more and more important and schools across the UK are recognising this. You can access free resources, training and support from our team here at Just Finance Foundation to help you embed financial education that truly meets the needs of your students.

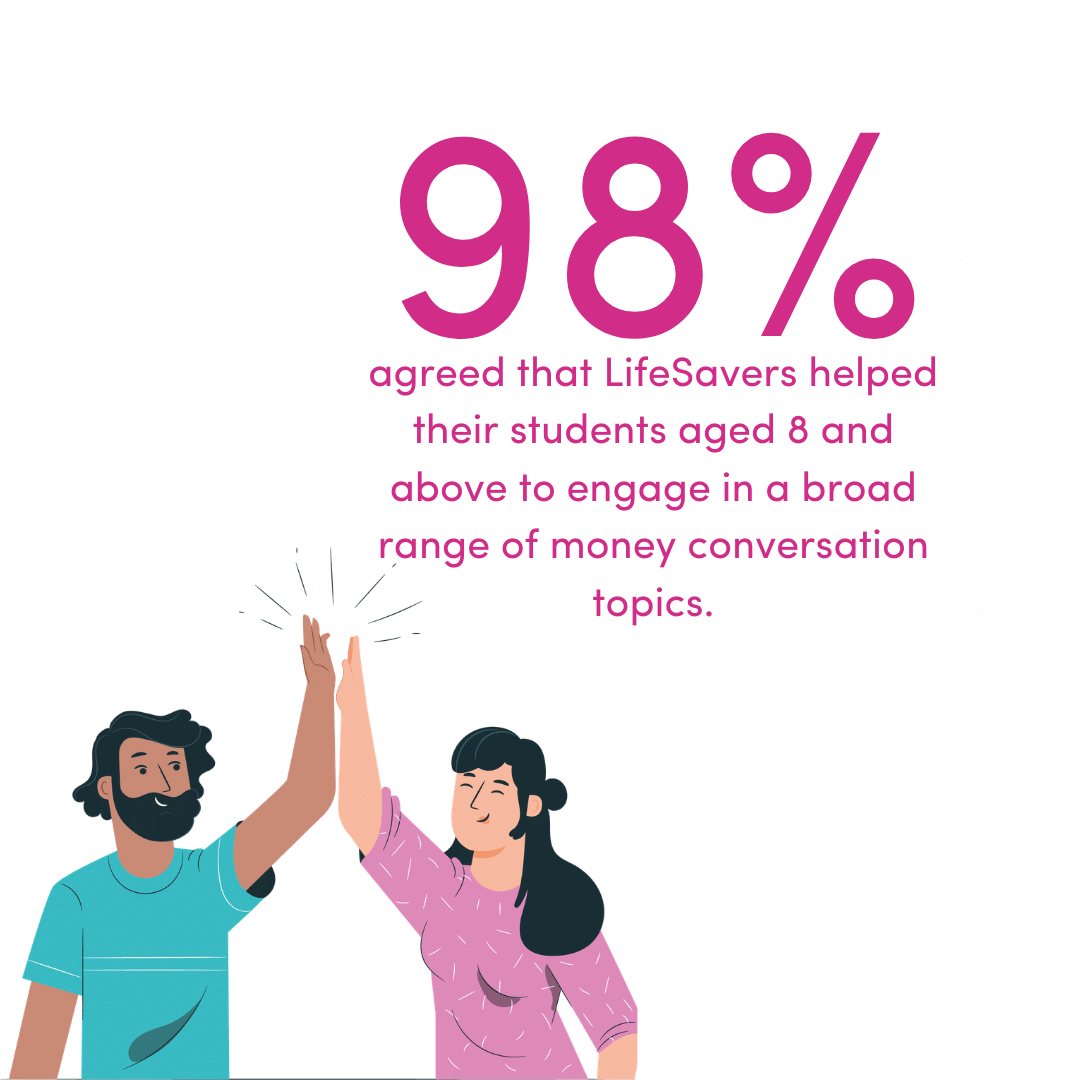

Teachers across the country are already making a measurable difference in their classrooms using our LifeSavers resources:

100% of teachers surveyed agree that LifeSavers has increased the conversations they are having with their students about money.

99% of teachers surveyed agree that LifeSavers has supported them to meet curriculum objectives.

97% of teachers surveyed agree that LifeSavers has supported them to meet education outcomes for their students.

98% of Early Years and KS1/First Level teachers surveyed agreed that LifeSavers had enabled their students to demonstrate an awareness of their own feelings about money.

Meaningful financial education starts with a good conversation. Our resources are centered around the idea of talking about money. Helping children to acquire the language and understanding they need is woven through all our resources and we feel that the best way for children to learn is to explore concepts, develop their thinking and consider options through talk. Meaningful learning isn’t necessarily developed by filling in a worksheet - giving children the opportunity to consider questions and relate ideas to their own experiences is a perfect way to secure good understanding.

Here are some of our top tips for securing great learning in financial education.

Using Storytelling to Support Financial Education in KS1, Early level and first level

Engage imagination! Develop language and the ability to process thinking through stories. Our Milo’s Money story book for younger children is a fantastic way to help children consider all the different things they can do with money.

‘Children have different experiences based on their home life, Milo provides all children with an equal opportunity to learn about financial education.’ - Interventions and Teaching Assistant

Reading the story and engaging children in talking about their ideas is a perfect way for them to learn. Children will love to talk about what they think Milo should do with his money. They will enjoy thinking about what they would do too. Giving them the opportunity to engage with thinking through the story is a great way to allow them to model learning.

Linking Financial Education to the Maths Curriculum

Keep it real! Look for links within the curriculum. Mathematics can be a great opportunity to blend learning. Children use money as a context for problem solving in mathematics so providing some time for them to delve deeper into financial contexts at the same time will only enrich their understanding of both key mathematical concepts and their financial knowledge.

Exploring budgeting and the choices and decisions we might need to make while shopping or saving will only add meaning to the numbers the children are encountering. This will have a much greater impact than just manipulating numbers in a calculation. Why not create a classroom shop with things for children to buy? You could also, if you have one close by, talk to a local shop or supermarket and take children there with a budget and shopping list in mind.

‘Learners are able to discuss the importance of saving and budgeting and state reasons why we need to be responsible with money.’ - Lauren Manning, Subject/Phase Lead, North East

Developing Financial Decision-Making Through Questioning

Make their brains fire up! Ask tricky questions! Thoughtful questions are central to our lesson activities and we like to get children scratching their heads and considering all the options they may have available to them. Our conversation cards pose questions which don’t necessarily have a single right answer, but which will be a fantastic spark to a discussion. They can be used within a lesson or even within a few minutes before a break or assembly as a ‘question for the day’.

Fun Financial Education Activities for KS2 and second level

Have fun! Enable children to ‘play’ with their thinking. Having an open minded approach to talking about money really does help children to develop their understanding more. Giving them the chance to explore different options and scenarios through talking and thinking or playing games helps them to see what impact making financial decisions can have.

Playing a game like our Money Adventure game with older KS2 or Second Level children is great for this, children can make decisions and then see what the possible consequences could be.

Securing Strong Financial Understanding in the Primary Classroom

So what does meaningful financial education look like? The answer is in giving the children the opportunity to explore their thinking, to relate what they are learning to their own lives and to have fun at the same time.

And the impact speaks for itself: schools using our approach consistently report increased confidence, higher engagement in money conversations and more thoughtful decision-making among pupils.

Providing opportunities, giving children the vocabulary they need, considering choices and rehearsing decisions, all vital elements in securing sound financial understanding in a primary classroom.

Be part of the movement building financially confident young people.

Subscribe to our Newsletter to receive practical tips, evidence-led learnings and free resources to strengthen financial education in your school.

Paul Street

Financial Education Delivery Coordinator at the Just Finance Foundation, Paul supports the development of the LifeSavers programme and contributes to in-depth research and case studies with schools to help elevate our work. He brings over 30 years’ experience in primary education as a teacher, local authority mathematics adviser and headteacher, and is passionate about improving children’s life chances through financial education.